Pros & Cons using TradeZero Stock Brokerage Company

( TradeZero Best Known for No PDT rule , Free Trades on Limit Orders )

Click Here To Register TradeZero Today

Im n't a Big Stock Player or well reputed top trader. Im same like most of you. A common Man , started trading since 2016. I struggled in finding best out of market for No PDT rule ( as I dont have 25K with me) , Good leverage and also who can provide best commissions

And being With tradezero for more than a year by now. I found this to be Best.

Not Like many other reviewers , Im n't here to promote Brokers , rather I always write down real experience using different platforms.

TradeZero.Co is online discount broker based in Nassau, Bahamas. As they are located out of United States , they don't need to compile with PDT Rule. Yes , you no need to worry about Pattern Day Trading rule even with smaller account size.

Also look over my post on UstockTrade to get No PDT rule For USA Citizens - smaller accounts

I personally prefer using TradeZero and I recommend it for

- Starters with small accounts who wants to skip PDT rule

- Intermediate level traders who can take advantage of Limit Free trades ( commission free ) and to short sell with 6X leverage amounts

- Experts in getting almost all the stock tickers located for shorting.

Lets see all the Pros ( Blue colored ) and Cons (Red Colored ) below

Look Over My article on How best you can find a Sympathy Play over a Huge Running Stock

Some of Pros & Cons on TradeZero account:

Opening Account & Minimum deposit

&& Leverage Given

- Minimum of 500$ can be used to Open account with TradeZero.

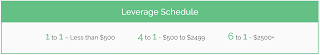

- You get 1:4 leverage from $500+ to $2499 and 1:6 Leverage on Cash balance Over $2500+

i.e you if you have 2500$ deposited , you get 2500x6 = 15000$ to day trade. - You can use leverage amounts only on Stocks Priced 3$ and above

Free Orders / Commissions and Fee

- Commission free trading on limit order executions - of share size 200 and or above with a minimum of 1-2 second gap on filling. (enlarge below image for more info )

- Stop Limits wont fall under this zone of Free Trades

- OTC stocks wont be under this too

- Btw Stock price under 1$ cant be traded for Free

- Charges on paid orders are below

Shorting stocks - Locate fee structure

- Most Important part of TradeZero is shorting stocks. You can locate almost all the stock tickers ( hard to barrow charges may differ from stock to stock )

- Shorting stocks is very easy that you can short almost every stock ticker using TZ

- Easy to Barrow stocks are very less or hard to find - among high volatile stocks - in other words , you have to pay and locate almost every stock which are of High momentum. ( Good thing here is , you can always find / locate shares and if stock is not Highly Volatile you would find it Easy to Barrow )

- Major issue, I found shorting stocks with TZ is .. You shouldn't hold short position overnight , if you do , you have to pay charges of 7X the borrowing charges on each share. ( where as , normal stocks held overnight with margin amounts will be charged as less as 8% annually )

Software Free

- There are many tools to trade stocks @ TZ , You can use Software tool , Web Zero and also ZeroFree ( Mobile app in addition )

- Charges on these are pretty low compared many tools available in market and also you can get it for free if you trade some count of shares per month ( details below )

You can get even lesser charges over these tools , if you register through MyBlogStory

- As TZ is OFFSHORE , they may not provide you Tax Documents. You have to deal with it by your own. ( But hopefully can be managed )

Over All -- TradeZero is best out of market for all day traders with << 25K to Avoid PDT rule and trade with free limit orders, also can short almost all stocks with good locate charges.

Being MyBlogStory Readers , You get discounted account by registering through us

Being MyBlogStory Readers , You get discounted account by registering through us

|